Securing a mortgage is like unlocking the door to your dream home. But getting approved for one can sometimes feel like solving a complex puzzle. Fear not, as we’ve got you covered with top tips that will pave the way to mortgage approval success! Whether you’re a first-time buyer or looking to refinance, buckle up as we dive into the world of mortgages and arm you with essential know-how. Let’s turn those homeownership dreams into reality together!

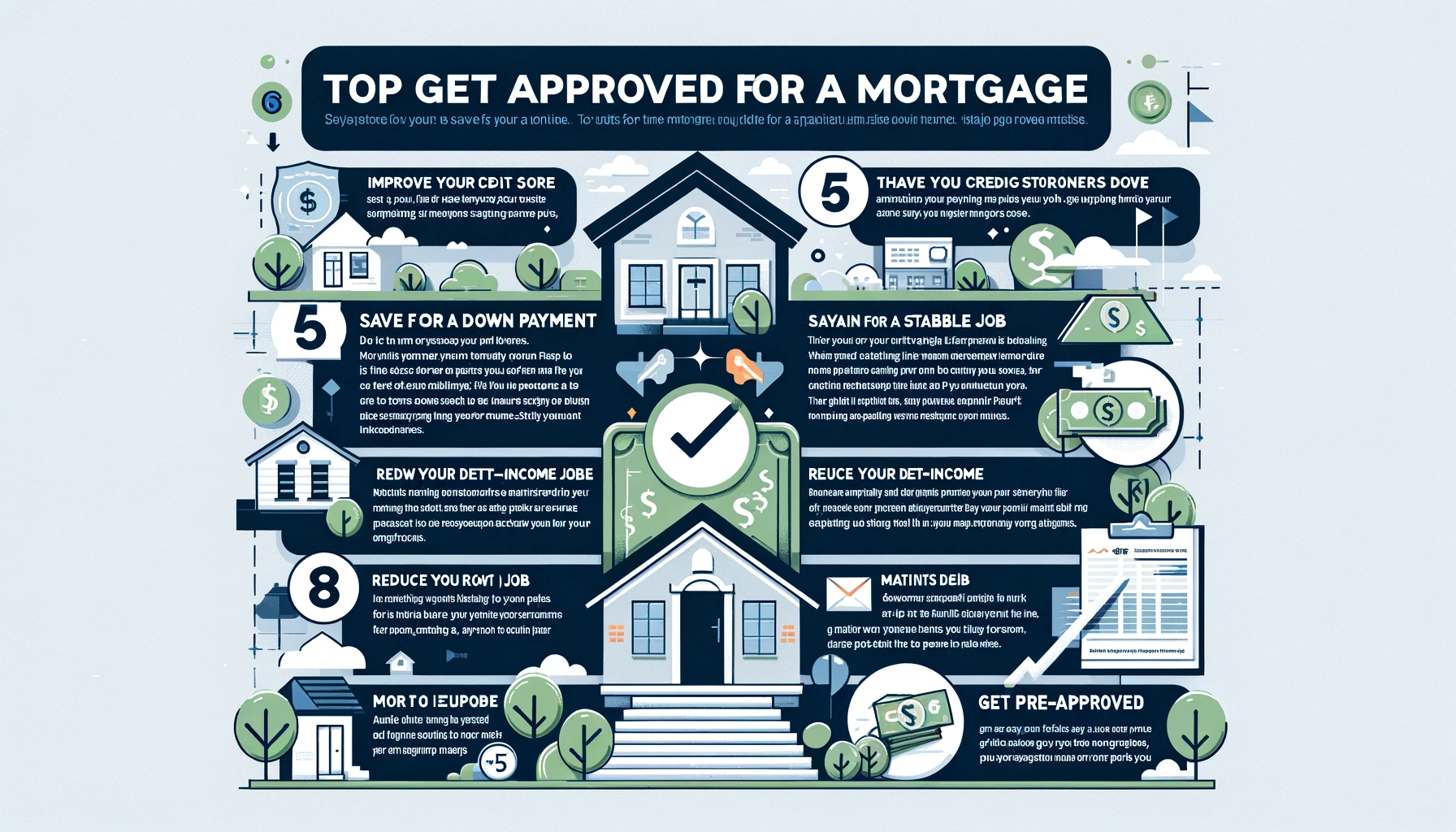

Top Tips for Getting Approved for a Mortgage

Navigating the mortgage approval process can be daunting, but fear not – we’ve got your back with these top tips. First and foremost, check your credit score before applying for a mortgage. Lenders use this crucial number to assess your financial health and determine loan eligibility.

Next up, save up for a down payment to show lenders you’re financially responsible and committed to the investment. Remember, the bigger the down payment, the better your chances of approval.

It’s also essential to reduce existing debt as much as possible before applying for a mortgage. Lower debt levels demonstrate financial stability and increase your likelihood of approval.

Get pre-approved before house hunting. This not only streamlines the process but also shows sellers that you’re a serious buyer ready to make offers. Keep these tips in mind to boost your chances of securing that coveted mortgage approval!

Mortgage Loan Basics

Are you considering buying a home and need to understand the basics of mortgage loans? Let’s dive into what you need to know.

A mortgage is a loan provided by a lender to help finance the purchase of real estate. The property itself serves as collateral for the loan, meaning if you fail to make payments, the lender can take possession of your home.

Mortgages involve various legal regulations and processes that borrowers must follow. Understanding these rules is crucial to ensure a smooth borrowing experience.

When applying for a mortgage, lenders will assess your financial situation through underwriting. This involves reviewing factors like credit score, income, employment history, and debt-to-income ratio.

There are different types of mortgages available depending on your needs and preferences. Common options include fixed-rate mortgages, adjustable-rate mortgages (ARMs), interest-only loans, and reverse mortgages.

Basic Concepts and Legal Regulation

Basic Concepts and Legal Regulation play a crucial role in the mortgage loan process. Understanding these fundamental principles is essential for anyone looking to secure a mortgage successfully.

When it comes to mortgages, basic concepts refer to the foundational elements of the loan agreement. This includes terms like principal amount, interest rate, repayment period, and collateral.

Legal regulations surrounding mortgages vary from country to country. In some regions, there are stringent laws governing mortgage lending practices to protect consumers from predatory behavior by lenders.

Comprehending these concepts and regulations can help borrowers make informed decisions when navigating the complex world of mortgages. It’s advisable to seek professional advice or consult legal resources if you have any doubts about your rights as a borrower.

Mortgage Underwriting

Mortgage underwriting is like the detective work of the lending world. It’s where your financial story gets scrutinized, analyzed, and ultimately determines if you’re a good candidate for a mortgage loan.

Underwriters dig deep into your credit history, income sources, debts, assets, and overall financial stability to assess the risk of lending to you. They want to ensure that you can afford the mortgage payments without putting yourself in financial jeopardy.

Your job during underwriting is to be transparent and provide all requested documentation promptly. Any missing information or discrepancies could potentially delay or even derail your approval process.

Remember, underwriters aren’t out to get you; they’re simply doing their due diligence to protect both the lender’s interests and yours as a borrower.

So, stay patient and cooperative throughout the underwriting process – it’s a crucial step towards securing that dream home!

Mortgage Loan Types

When it comes to mortgage loan types, there are several options available to suit different financial situations and preferences. One common type is a fixed-rate mortgage, where the interest rate remains constant throughout the life of the loan. This provides predictability in monthly payments for homeowners.

On the other hand, adjustable-rate mortgages have interest rates that can fluctuate based on market conditions. While initially offering lower rates, they can increase over time, impacting monthly payments.

Interest-only loans allow borrowers to pay only the interest for a set period before starting to repay both principal and interest. This option can be appealing for those looking for flexibility in their finances.

Reverse mortgages are tailored towards older homeowners who want to convert part of their home equity into cash without selling their home. These loans offer financial relief by providing funds while still living in the property.

Understanding these mortgage loan types can help you make an informed decision when choosing the right option for your homeownership journey.

## Repaying the Mortgage

Repaying a mortgage is a significant financial commitment that requires careful planning and budgeting. Understanding how your mortgage payment breaks down can help you manage your finances effectively.

When you make your monthly mortgage payment, it typically consists of two main components: principal and interest. The principal is the amount borrowed, while the interest is what the lender charges for lending you the money.

Interest-only loans allow borrowers to pay only the interest for a specified period before beginning to repay the principal. While this option may offer lower initial payments, it’s essential to understand how it affects your overall repayment schedule.

Reverse mortgages are tailored for older homeowners looking to convert their home equity into cash. With this type of loan, repayment is typically deferred until the borrower moves out or passes away.

It’s crucial to assess your financial situation carefully before committing to a mortgage and consider all available options based on your circumstances.

Principal and Interest

When you apply for a mortgage, understanding the concept of principal and interest is crucial. The principal is the amount you borrow to buy your home, while the interest is what the lender charges you for borrowing that money.

Each month, your mortgage payment will typically go towards paying off a portion of the principal and covering the interest. As time goes on, more of your payment will start going towards reducing the principal balance.

Paying down the principal faster can help you build equity in your home quicker and reduce the overall cost of your loan over time. It’s like gradually owning more and more of your property with each payment.

By keeping an eye on how much of each payment goes towards the principal versus interest, you can track progress towards homeownership and make informed decisions about managing your mortgage effectively.

Interest-Only Loans

Interest-only loans can be an attractive option for some borrowers due to their unique structure. With this type of mortgage, you have the flexibility to pay only the interest on the loan for a set period, typically 5-10 years. This means lower monthly payments during the initial phase of the loan.

However, it’s important to understand that once the interest-only period ends, your payments will increase significantly since you will then start paying both principal and interest. This spike in payments can catch some borrowers off guard if they haven’t planned accordingly.

Interest-only loans are not suitable for everyone and may carry more risk compared to traditional mortgages. It’s essential to carefully weigh the pros and cons before deciding if this type of loan is right for your financial situation. Be sure to consult with a trusted mortgage advisor to explore all your options thoroughly.

Reverse Mortgages

Have you heard about reverse mortgages? This unique type of loan is designed for homeowners aged 62 and older. Instead of making monthly payments to the lender, the homeowner receives payments based on the equity in their home. It can be a great option for retirees looking to supplement their income or cover unexpected expenses.

With a reverse mortgage, you retain ownership of your home while tapping into its value. The loan doesn’t have to be repaid until you move out or pass away, at which point the home is typically sold to pay off the balance. Keep in mind that interest accrues over time, so it’s important to weigh the pros and cons before deciding if a reverse mortgage is right for you.

This financial tool can provide flexibility and financial stability for older homeowners who may not qualify for traditional loans due to retirement income limitations. However, like any financial decision, it’s essential to do thorough research and consult with a financial advisor before proceeding with a reverse mortgage.

National Differences

When it comes to mortgages, national differences play a significant role in shaping the landscape of homeownership. In the United States, the mortgage market is vast and diverse, offering various loan options tailored to different financial situations. From fixed-rate mortgages to adjustable-rate mortgages, borrowers have a plethora of choices.

In Canada, stringent regulations ensure stability in the housing market by implementing stress tests for borrowers to qualify for loans. The United Kingdom boasts a competitive mortgage market with lenders vying for customers through attractive interest rates and incentives.

Continental Europe’s mortgage system varies from country to country, with some nations favoring fixed-rate mortgages while others prefer adjustable rates. Malaysia stands out for its Islamic home financing options that comply with Sharia law principles.

Across Islamic countries, mortgages adhere to strict religious guidelines prohibiting interest payments but allowing profit-sharing arrangements between lenders and borrowers. These national nuances underscore the importance of understanding local real estate practices when navigating the world of mortgages.

United States

The United States mortgage market is diverse and dynamic, catering to a wide range of borrowers with varying needs. With various loan options available, from conventional mortgages to government-backed loans like FHA or VA loans, there’s something for everyone in the U.

S. housing market.

Interest rates play a crucial role in the American mortgage landscape, influencing affordability and homeownership levels across the country. Understanding how these rates fluctuate can help potential homebuyers make informed decisions when securing a mortgage.

The process of obtaining a mortgage in the United States involves thorough documentation, credit checks, and financial assessments to ensure borrowers meet lender criteria. It’s essential for applicants to have their financial house in order before embarking on this journey.

Regulations surrounding mortgages in the U.

S. aim to protect both lenders and borrowers, ensuring fair practices are upheld throughout the lending process. Being aware of these regulations can empower individuals seeking homeownership opportunities nationwide.

Canada

Canada offers a diverse range of mortgage options for homebuyers. From fixed-rate mortgages to adjustable-rate mortgages, Canadians have the flexibility to choose what works best for their financial situation. The Canadian housing market is known for its stability, making it an attractive option for those looking to invest in real estate.

When applying for a mortgage in Canada, lenders typically look at factors such as credit score, income stability, and debt-to-income ratio. It’s important to have these in order before beginning the application process to increase your chances of approval. Additionally, understanding the legal regulations surrounding mortgages in Canada is crucial to avoid any surprises down the line.

For Canadians navigating the mortgage process, seeking guidance from professionals like mortgage brokers can be beneficial. They can help you compare different mortgage offers and find one that aligns with your needs and goals. Securing a mortgage in Canada requires careful consideration and strategic planning to make informed decisions that set you up for success in homeownership.

United Kingdom

The mortgage landscape in the United Kingdom offers a variety of options for potential homebuyers. From fixed-rate mortgages to adjustable-rate mortgages, borrowers can choose what best suits their financial situation.

In the UK, getting approved for a mortgage often involves proving your income stability and demonstrating your ability to repay the loan. Lenders will typically assess your credit score, employment history, and debt-to-income ratio.

It’s important to understand the differences between mortgage products available in the UK market. Whether you opt for a traditional fixed-rate mortgage or consider an interest-only loan, each option comes with its own set of pros and cons.

Additionally, staying informed about average mortgage rates in the UK can help you make better decisions when applying for a loan. Comparing different lenders and their offerings is crucial to securing favorable terms on your mortgage agreement.

Navigating the world of mortgages in the United Kingdom requires research, financial preparation, and careful consideration before making any commitments.

Continental Europe

When it comes to mortgages in Continental Europe, each country has its own unique regulations and practices. In countries like France and Germany, fixed-rate mortgages are more common, offering stability for homeowners over the long term. On the other hand, countries like Spain and Italy may have more variable rate options available.

In some European countries, such as Switzerland or Sweden, it’s not uncommon for individuals to have a high level of personal savings before being approved for a mortgage. This can be quite different from the requirements in other parts of the world.

The housing market trends in places like the Netherlands or Belgium can also impact mortgage approval rates. Understanding these regional nuances is crucial when navigating the mortgage process in Continental Europe. Each country presents its own set of challenges and opportunities for potential homeowners seeking loan approval.

Malaysia

Malaysia offers a diverse mortgage market with various options to suit different needs. With a growing economy and competitive interest rates, securing a mortgage in Malaysia can be an attractive option for many homebuyers.

One unique aspect of the Malaysian mortgage market is the availability of Islamic home financing known as ‘Musharakah Mutanaqisah.’ This Shariah-compliant alternative provides an opportunity for Muslim homebuyers to finance their homes without involving interest.

In Malaysia, it’s common for banks to offer both fixed-rate and variable-rate mortgages, allowing borrowers to choose the option that aligns best with their financial goals and risk tolerance. Additionally, some lenders may require lower down payments compared to other countries, making homeownership more accessible.

Navigating the mortgage landscape in Malaysia requires understanding the local regulations and seeking guidance from experienced professionals to make informed decisions tailored to individual circumstances.

Islamic Countries

Islamic countries have unique practices when it comes to mortgages. In Islamic finance, traditional interest-based loans are not allowed. Instead, Islamic mortgages adhere to Sharia law principles.

One common type of Islamic mortgage is Murabaha, where the bank buys the property and then sells it to the buyer at a markup price that can be paid in installments.

Another form is Ijara, which works like a lease-to-own agreement where the bank purchases the property and leases it back to the buyer with an option to buy at a later date.

Islamic countries have financial institutions specializing in Sharia-compliant financing options for those looking to purchase homes while following their religious beliefs. These institutions provide alternative solutions for homeownership within Islamic guidelines.

Mortgage Process

Getting a mortgage can be an exciting yet daunting process. It involves several steps that are crucial in securing your dream home. The first step is to gather all necessary documents such as proof of income, credit history, and employment information.

Once you have your paperwork ready, the next step is to shop around for lenders and compare their offers. It’s important to find a lender that fits your needs and offers competitive rates.

After choosing a lender, you will need to complete a mortgage application and undergo the underwriting process. This stage involves a thorough review of your financial status to determine if you qualify for the loan.

If approved, you will receive a pre-approval letter which shows sellers that you are a serious buyer. From here, it’s time to start house hunting with confidence knowing that you have been approved for a mortgage.

Getting a Mortgage

Thinking about getting a mortgage can be both exciting and daunting. It marks a significant step towards owning your dream home, but the process can seem overwhelming at first.

To start, you’ll need to gather all necessary financial documents like pay stubs, tax returns, and bank statements. Lenders will use this information to assess your financial health and determine how much they’re willing to lend you.

Next, it’s crucial to check your credit score before applying for a mortgage. A higher credit score usually translates into better loan terms and interest rates.

Research different lenders and compare their offers to find the best fit for your needs. Don’t hesitate to ask questions or seek clarification on anything you don’t understand – transparency is key in such transactions.

Be prepared for some back-and-forth with the lender during the application process. Stay organized, responsive, and patient as you work towards securing that coveted mortgage approval!

Maintaining a Mortgage

Maintaining a mortgage is an ongoing commitment that involves more than just making monthly payments on time. It’s essential to stay informed about your loan terms, interest rates, and any changes in the housing market that could impact your financial situation.

Regularly reviewing your budget and expenses can help you ensure that you are managing your mortgage payments effectively. It’s important to prioritize your mortgage obligations to avoid falling behind on payments and risking default.

In addition to staying organized with your finances, maintaining open communication with your lender is crucial. If you encounter any difficulties or anticipate challenges in making payments, reaching out proactively can often lead to finding alternative solutions or payment plans.

Taking proactive steps towards maintaining a mortgage not only helps protect your investment but also contributes to building a strong financial foundation for the future. By staying diligent and informed throughout the life of your mortgage, you can navigate potential hurdles with confidence and secure long-term stability for yourself and your family.

Coronavirus Affecting Your Mortgage or Housing?

The ongoing coronavirus pandemic has undeniably impacted various aspects of our lives, including the housing market and mortgages. With economic uncertainties, individuals may face challenges in meeting mortgage payments or securing new loans due to job loss or income reduction.

Lenders have implemented relief measures such as forbearance programs to assist homeowners facing financial hardships during this time. However, it’s crucial to communicate with your lender transparently about your situation and explore available options before missing any payments.

For those considering buying a home amidst the pandemic, fluctuations in interest rates and stricter lending criteria may affect loan approvals. It’s essential to stay informed about market changes and work closely with lenders to navigate through these uncertainties successfully.

As we continue to adapt to the evolving circumstances brought by the virus, staying proactive and informed will be key in managing your mortgage effectively during these challenging times.

Tips for Approval

Securing approval for a mortgage can be a significant milestone in your journey to homeownership. To increase your chances of getting approved, start by understanding your financial situation thoroughly. Take the time to review your credit score and history, as they play a crucial role in the approval process.

Next, consider taking proactive steps to improve your credit profile if needed. Paying off outstanding debts and ensuring timely payments on existing accounts can help boost your creditworthiness. Additionally, saving up for a larger down payment can demonstrate financial stability to lenders.

When applying for a mortgage, make sure to shop around and compare offers from different lenders. Each lender may have varying requirements and interest rates, so it’s essential to find the best fit for your circumstances. Be prepared to provide all necessary documentation promptly and accurately during the application process.

Seek professional guidance if you encounter any challenges along the way. A mortgage broker or financial advisor can offer valuable insights and assistance in navigating the approval process successfully.

Understanding Your Situation

Understanding your situation is crucial when applying for a mortgage. Before diving into the application process, take a close look at your financial health. Evaluate your income stability, credit score, and existing debts. This self-assessment will give you a clear picture of where you stand financially.

Consider your long-term goals and how homeownership fits into them. Are you looking to settle down in one place or are you more inclined towards flexibility? Understanding what you want out of a home can help guide your mortgage decisions.

Take the time to research different types of mortgages available and determine which aligns best with your financial situation and goals. Whether it’s a fixed-rate or adjustable-rate mortgage, knowing the options can empower you to make an informed choice.

Consulting with a financial advisor or mortgage broker can provide valuable insights tailored to your specific circumstances. They can offer guidance on navigating the complexities of mortgage applications and approvals.

Taking Action

When it comes to getting approved for a mortgage, taking action is key. Start by reviewing your credit report and addressing any issues that may negatively impact your score. Pay down outstanding debt and avoid making large purchases before applying for a mortgage.

Next, gather all necessary documents such as pay stubs, tax returns, and bank statements to demonstrate your financial stability to lenders. Consider getting pre-approved for a mortgage to show sellers that you are serious about buying.

Research different types of mortgages and interest rates to find the best option for your financial situation. Compare offers from multiple lenders to ensure you are getting the most competitive terms available.

Stay organized throughout the application process by keeping track of deadlines and requirements. Communicate openly with your lender and be prepared to provide additional information if requested.

Taking proactive steps can increase your chances of securing approval for a mortgage on favorable terms. Remember, knowledge is power when it comes to navigating the home loan process effectively.

Common Issues

Common issues that may arise when applying for a mortgage can be daunting. One prevalent problem is credit score-related, where a low credit score can hinder approval. Lenders often look for scores above 620 to qualify for conventional loans. Another issue could be insufficient income or unstable employment history, making lenders hesitant about the borrower’s ability to repay the loan.

Down payments are another common stumbling block; while some programs allow for lower down payments, traditional mortgages typically require 20% down. Debt-to-income ratio exceeding guidelines is also an obstacle as it signals potential financial strain in meeting monthly payments.

Furthermore, lack of documentation or incomplete paperwork can delay the approval process significantly. It’s crucial to have all necessary documents organized and up-to-date when applying for a mortgage to avoid unnecessary setbacks.

Knowing Your Rights

Understanding your rights as a mortgage borrower is crucial in ensuring you are treated fairly throughout the process. It’s important to know that you have the right to receive clear and accurate information about your loan terms, interest rates, and fees. Additionally, you have the right to ask questions and seek clarification on any aspect of the mortgage agreement.

As a borrower, it’s essential to be aware of anti-discrimination laws that protect you from being unfairly denied a mortgage based on factors such as race, gender, or disability. You also have the right to file a complaint if you believe you have been subjected to discriminatory practices during the lending process.

Furthermore, familiarize yourself with consumer protection regulations that safeguard your interests as a homeowner. These regulations outline your rights regarding loan modifications, foreclosure processes, and debt collection practices. By knowing your rights upfront, you can advocate for yourself effectively in case of any disputes or issues with your mortgage lender.

Mortgage Options Comparison

When it comes to choosing a mortgage, there are various options available to suit your financial needs and goals. One common type is the fixed-rate mortgage, where your interest rate remains constant throughout the loan term, providing stability in your monthly payments.

On the other hand, adjustable-rate mortgages offer lower initial rates that can fluctuate over time based on market conditions. This option may be suitable if you plan to sell or refinance before any potential rate increase kicks in.

Interest-only loans allow borrowers to pay only the interest for a specified period before starting to repay the principal. While this can provide flexibility initially, it’s essential to understand how your payments will change once principal repayment begins.

Reverse mortgages cater primarily to seniors who own their homes outright and want to convert part of their equity into cash without selling or moving out. It’s crucial to consider all aspects carefully before deciding which mortgage option aligns best with your financial situation.

Fixed-Rate Mortgages

When considering a mortgage, one popular option to explore is a fixed-rate mortgage. This type of loan locks in your interest rate for the entire term, providing predictability and stability in your monthly payments. With fixed-rate mortgages, you won’t have to worry about fluctuations in interest rates impacting your budget.

One key advantage of a fixed-rate mortgage is that it offers peace of mind knowing exactly how much you need to pay each month. This can be especially beneficial for those who prefer consistency and want to avoid any surprises in their housing expenses.

Additionally, fixed-rate mortgages are often recommended for long-term homeowners planning to stay in their homes for an extended period. The steady interest rate allows you to budget effectively over the years without worrying about potential increases.

If you value reliability and want assurance in your monthly payments, exploring a fixed-rate mortgage may be a wise decision when navigating the home loan market.

Adjustable-Rate Mortgages

Are you considering an adjustable-rate mortgage (ARM) for your home purchase? These types of mortgages offer a lower initial interest rate compared to fixed-rate options. With ARMs, your interest rate can vary over time based on market conditions. This means that your monthly payments could fluctuate as well.

It’s crucial to understand the terms and risks associated with adjustable-rate mortgages before committing. Be aware of how often the interest rate can adjust, the maximum limits on these adjustments, and any potential caps in place to protect you from drastic increases.

While ARMs can be beneficial if you plan to sell or refinance before the adjustment period kicks in, they come with inherent risks. Market fluctuations could lead to higher monthly payments down the line, impacting your financial stability.

Consulting with a mortgage specialist can help you determine if an adjustable-rate mortgage aligns with your long-term financial goals and risk tolerance level. Make sure to weigh all options carefully before making a decision.

Interest-Only Loans

Interest-only loans can be an attractive option for borrowers looking to lower their initial mortgage payments. With this type of loan, you only pay the interest on the principal amount for a set period, typically 5-10 years. This means your monthly payments are lower during the interest-only period compared to traditional mortgages.

However, it’s essential to understand that after the interest-only period ends, you’ll need to start repaying both the principal and interest. This can result in significantly higher monthly payments once the full repayment kicks in. It’s crucial to carefully consider whether you’ll be able to afford these increased payments down the line.

Interest-only loans can provide flexibility for some borrowers, especially those expecting a significant increase in income or planning to sell their property before the end of the interest-only period. As with any financial decision, thorough research and consultation with a mortgage advisor are key before committing to an interest-only loan.

Reverse Mortgages

Curious about Reverse Mortgages? This unique financial product is designed for homeowners aged 62 and older. With a Reverse Mortgage, you can convert part of your home equity into cash without selling your home. Sounds intriguing, right?

Unlike traditional mortgages where you make monthly payments to the lender, with a Reverse Mortgage, the lender pays you through various disbursement options like lump sum payments or lines of credit. It allows retirees to supplement their income or cover unexpected expenses.

One key feature of Reverse Mortgages is that borrowers don’t have to repay the loan until they move out of the house permanently or pass away. That’s quite different from conventional loans!

Before diving into a reverse mortgage agreement, it’s vital to understand all terms and conditions thoroughly. Seek advice from financial advisors or housing counselors specialized in this area for guidance tailored to your situation.

Intrigued by the possibilities of unlocking your home’s equity in retirement? Consider exploring whether a reverse mortgage could be a suitable option for you and your future financial needs!

Mortgage Rates and Analysis

Mortgage rates are a key factor to consider when diving into the world of homeownership. Understanding how they work can help you make informed decisions about your financial future. When analyzing mortgage rates, it’s essential to keep an eye on trends in the market. Rates can fluctuate based on various economic factors, so staying informed is crucial.

Comparing different mortgage options can also give you insight into which loan type may be the best fit for your needs and budget. Fixed-rate mortgages offer stable payments over time, while adjustable-rate mortgages may have lower initial rates but carry more risk as rates change.

Taking the time to research and analyze mortgage rates thoroughly can lead to significant savings over the life of your loan. By staying knowledgeable about current market conditions and exploring all available options, you can position yourself for success in securing a favorable mortgage rate that aligns with your financial goals.

Average Mortgage Rates

When it comes to mortgage rates, staying informed is key. The average mortgage rates fluctuate based on various factors such as economic conditions, lender policies, and market trends.

Understanding the current average mortgage rates can help you make informed decisions when considering buying a home or refinancing your existing loan. It’s essential to keep track of these rates to ensure you are getting the best deal possible.

By comparing different lenders’ offers and staying updated on the average rates in your area, you can potentially save thousands of dollars over the life of your loan. Remember that even a small difference in interest rates can have a significant impact on your monthly payments and overall cost.

Whether you’re a first-time homebuyer or looking to refinance, taking the time to research and compare average mortgage rates can ultimately lead to substantial savings in the long run.

Comparing Mortgages

When looking at mortgages, it’s crucial to compare your options carefully. One key factor to consider is the interest rate – whether you opt for a fixed-rate mortgage with stable payments or an adjustable-rate one that can change over time. Think about the loan term too; shorter terms may mean higher monthly payments but less interest paid overall.

Lenders also have different requirements and fees, so comparing these aspects can save you money in the long run. Don’t forget to look into any special programs or incentives offered by lenders, such as first-time homebuyer benefits or down payment assistance.

Consider reaching out to multiple lenders to get quotes and understand their offerings fully before making a decision. Choosing the right mortgage involves weighing all these factors and finding a loan that aligns with your financial goals and circumstances.

Additional Resources

Looking for more information on mortgages? Additional resources can provide valuable insights and tools to guide you through the mortgage process.

Legal disclaimers are essential when diving into the world of mortgages, ensuring you understand your rights and obligations clearly. Real stories about mortgages shared by others can offer practical advice and lessons learned from real-life experiences.

A mortgage calculator is a handy tool that helps you estimate monthly payments based on different loan amounts, interest rates, and terms. It can assist in budgeting and planning for homeownership.

Committing to homeownership is a significant decision. Understanding the long-term commitment involved is crucial before taking the plunge into this financial responsibility.

Legal Disclaimer

It’s essential to understand the legal implications when it comes to mortgages. A legal disclaimer on a mortgage-related website or document serves as a precautionary measure. This disclaimer typically outlines the terms and conditions under which information is provided, protecting both the lender and borrower.

The legal disclaimer may include important details about accuracy, completeness, and timeliness of the information shared. It often states that the content is for informational purposes only and not meant as professional advice. Additionally, it might highlight that laws and regulations vary by location, urging individuals to seek personalized guidance.

By including a legal disclaimer, lenders can mitigate potential liabilities arising from misunderstandings or misinterpretations of their content. Borrowers are also encouraged to carefully read through these disclaimers before proceeding with any financial decisions related to mortgages.

Real Stories About Mortgages

Real stories about mortgages can offer valuable insights into the home buying process. From first-time buyers navigating through paperwork to seasoned homeowners refinancing for a better rate, every story is unique. These narratives shed light on the challenges and successes that come with securing a mortgage.

One family might share their experience of being approved for a fixed-rate mortgage, providing stability in uncertain times. Another individual may recount how an adjustable-rate mortgage allowed them to take advantage of lower interest rates over time.

These real-life accounts can serve as inspiration for those embarking on their own mortgage journey. They highlight the importance of thorough research, financial planning, and understanding your options before committing to a loan. By learning from others’ experiences, you can make more informed decisions when it comes to your own mortgage choices.

Whether heartwarming or cautionary, these stories remind us that behind every mortgage application is a person with dreams of homeownership and financial security.

Mortgage Calculator

Are you curious about how much your monthly mortgage payments might be? A mortgage calculator is a handy tool that can give you a rough estimate of what to expect. By inputting details like the loan amount, interest rate, and term length, you can quickly see an approximation of your potential payments.

These calculators are user-friendly and provide valuable insights into different scenarios. Whether you’re considering refinancing or buying a new home, playing around with various numbers can help you make informed decisions about your financial future.

Keep in mind that while a mortgage calculator can offer estimates, it’s essential to consult with a professional lender for accurate information tailored to your specific situation. It’s always best to gather multiple quotes and explore all options before committing to such a significant financial decision.

Homeownership Commitment

Owning a home is an exciting journey that comes with responsibilities and commitments. Once you have successfully obtained a mortgage, it marks the beginning of your homeownership commitment. This commitment goes beyond just paying your monthly installments; it involves maintaining your property, keeping up with repairs, and ensuring that you protect your investment for the future.

Remember, getting approved for a mortgage is just the first step in achieving your dream of homeownership. It’s essential to stay informed about the process, understand all aspects of your loan agreement, and be proactive in managing your finances to ensure that you can meet your obligations.

By following the top tips outlined in this article and staying informed about mortgage options and rates, you can navigate the complex world of mortgages with confidence. With careful planning, financial discipline, and a commitment to homeownership, you can turn your dream of owning a home into a reality. Congratulations on taking this important step towards securing your future!